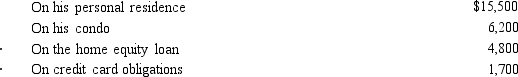

Ted, who is single, owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March, he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During the year, he paid the following amounts of interest.  What amount, if any, must Ted recognize as an AMT adjustment in 2018?

What amount, if any, must Ted recognize as an AMT adjustment in 2018?

Definitions:

Happiness

A state of well-being and contentment characterized by positive emotions ranging from contentment to intense joy.

Fulfillment

A feeling of happiness or satisfaction resulting from achieving one's potential or realizing one's desires.

Psychological Resilience

The ability of an individual to mentally or emotionally cope with a crisis or to return to pre-crisis status quickly.

Conservation Of Resources

A principle in stress theory suggesting individuals strive to retain, protect, and build resources and that stress occurs when resources are threatened with loss or are actually lost.

Q12: Druganaut Company buys a $21,000 van on

Q27: George is a limited partner in the

Q28: Devendra Company pays cash dividends of $600.

Q35: U.S.income tax treaties typically:<br>A)Provide for taxation exclusively

Q40: In allocating interest expense between U.S.and foreign

Q41: Which of the following statements is correct?<br>A)If

Q77: In computing the property factor, property owned

Q90: The starting point of the accounting process

Q110: Limited partner<br>A)Organizational choice of many large accounting

Q117: At the beginning of the year, Ryan's