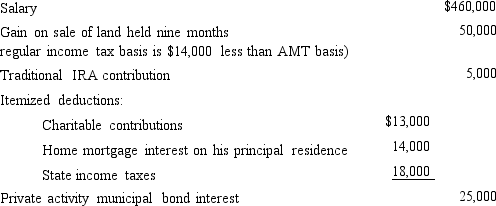

Gunter, who is divorced, provides you with the following financial information for the current year.Calculate Gunter's AMTI.

Definitions:

Tax-exempt

Not subject to tax by federal or local authorities, often applicable to certain income, property, or organizations.

Medical Expenses

Costs for healthcare services, treatments, prescriptions, and other medical needs that may be partially deductible on one's taxes.

Moving Expenses

Costs incurred for relocating for a new job or business location that were once deductible under certain conditions, but are now limited following recent tax law changes.

Old Residence

Refers generally to a taxpayer's previous home or dwelling before moving to a new location.

Q38: An S shareholder's stock basis is reduced

Q44: If any entity electing S status is

Q55: Each of the following can pass profits

Q63: The purpose of the work opportunity tax

Q68: Brenda correctly has calculated her regular tax

Q69: Aggregate concept<br>A)Organizational choice of many large accounting

Q70: Camper Van Company purchased equipment for $2,600

Q85: If the AMT base is greater than

Q96: Wally contributes land adjusted basis of $30,000;

Q105: General Corporation is taxable in a number