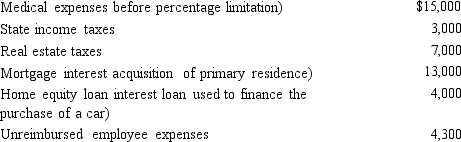

Mitch, who is single and age 46 and has no dependents, had AGI of $100,000 this year.His potential itemized deductions were as follows.  What is the amount of Mitch's AMT adjustment for itemized deductions for 2018?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2018?

Definitions:

Oxytocin

A hormone and neurotransmitter commonly associated with childbirth and bonding, often referred to as the "love hormone" for its role in promoting social and parental bonding.

Endorphins

Natural chemicals in the body that interact with brain receptors to reduce pain perception and lead to feelings of euphoria.

NK Cells

Natural Killer cells, a type of white blood cell that plays a crucial role in the body's immune response by targeting and killing virally infected cells and tumor cells.

External Locus

A belief system where individuals perceive their successes or failures as influenced by external forces or luck, rather than their own actions.

Q3: Which transaction affects the Other Adjustments Account

Q43: Precontribution gain<br>A)Adjusted basis of each partnership asset.<br>B)Operating

Q49: A U.S.taxpayer may take a current FTC

Q59: In determining taxable income for state income

Q75: Section 721 provides that no gain or

Q80: A corporation that distributes a property dividend

Q92: Property distributed by a corporation as a

Q92: Under what circumstances, if any, do the

Q114: The Code treats corporate distributions that are

Q157: International standards are developed by the<br>A) IFRS.<br>B)