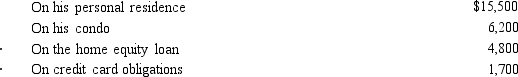

Ted, who is single, owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March, he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During the year, he paid the following amounts of interest.  What amount, if any, must Ted recognize as an AMT adjustment in 2018?

What amount, if any, must Ted recognize as an AMT adjustment in 2018?

Definitions:

Anorexia Nervosa

An eating disorder characterized by an intense fear of gaining weight and a distorted body image, leading to severe restriction of food intake.

Amenorrhea

The absence of menstruation in a person of reproductive age, which can be categorized as primary or secondary.

Impaired Heart

A condition where the heart's functioning is below normal capacity, potentially affecting its ability to pump blood effectively.

Cognitive Component

Refers to the thoughts, beliefs, and knowledge one has about a given subject, part of the attitude component in psychology.

Q19: If total liabilities decreased by $50,000 and

Q23: Julie and Kate form an equal partnership

Q40: An S corporation election for Federal income

Q58: Molly is a 30% partner in the

Q60: Any unused general business credit must be

Q84: A balance sheet reports the assets and

Q98: The starting point in computing state taxable

Q110: A trial balance may balance even when

Q116: Which item is not included in an

Q189: Which of the following is not part