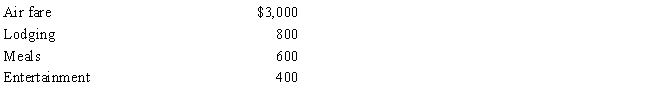

During the year, Sophie went from Omaha to Lima (Peru) on business. She spent four days on business, two days on travel, and four days on vacation. Disregarding the vacation costs, Sophie's unreimbursed expenses are:  Sophie's deductible expenses are:

Sophie's deductible expenses are:

Definitions:

Close-Substitute

A product or service that can easily replace another in the consumption preferences of consumers due to its similarity.

Complements

Goods or services that are consumed together because the use of one enhances the value of the other.

Cholesterol

A waxy, fat-like substance found in all cells of the body, necessary for making hormones, vitamin D, and substances that help digest foods, but high levels can lead to health issues.

Cattle Feed

involves materials and nutritional supplies consumed by cattle, aiming at ensuring proper growth, health, and productivity of the livestock.

Q28: Richard, age 50, is employed as an

Q32: A taxpayer who expenses circulation expenditures in

Q49: Describe the types of activities and taxpayers

Q75: Lily went from her office in Portland

Q76: Roger owns and actively participates in the

Q103: Ned, a college professor, owns a separate

Q113: Maria, who is single, had the following

Q123: The income of a sole proprietorship is

Q125: Factors that can cause the adjusted basis

Q133: Under the actual cost method, which, if