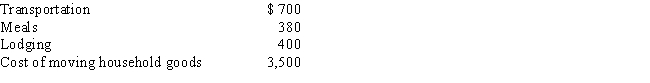

After graduating from college, Clint obtained employment in Omaha. In moving from his parents' home in Baltimore to Omaha, Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Definitions:

Functional Architecture

The conceptual framework for understanding the structure and functioning of a system, often used in describing the organizing principles of complex biological or technological systems.

Romantic Love

A deep emotional and affectionate bond characterized by a strong desire for emotional unity with another person.

Brain

The organ located in the skull of vertebrates responsible for the central nervous system's functions, including processing sensory information, regulating bodily functions, and enabling cognition and emotions.

Religious Identity

An individual's sense of belonging to a particular religion or belief system, which can shape their values, behaviors, and worldview.

Q1: What is the appropriate tax treatment for

Q5: Julie, who is single, has the following

Q25: In May 2017, after 11 months on

Q42: Carla is a deputy sheriff. Her employer

Q50: A baseball team that pays a star

Q63: In 2017, Marci is considering starting a

Q75: Brian, a self-employed individual, pays state income

Q91: Last year, Wanda gave her daughter a

Q124: If a taxpayer can satisfy the three-out-of-five

Q133: If part of a shareholder/employee's salary is