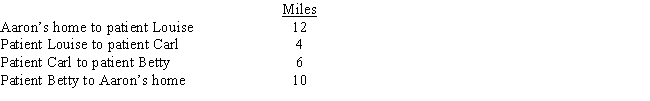

Aaron is a self-employed practical nurse who works out of his home. He provides nursing care for disabled persons living in their residences. During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Fair Value

A measurement of the price at which an asset would be bought or sold in a current market transaction.

Ethical Dilemma

A situation in which a person is faced with multiple choices and the decision involves a conflict of ethical values.

Alternatives

Different options or choices available to decision-makers.

Ethical Situation

A scenario or decision-making process that involves determining the right course of action in situations where moral considerations are relevant.

Q22: During 2016, the first year of operations,

Q31: If an owner participates for more than

Q38: Leona borrows $100,000 from First National Bank

Q46: How does the FICA tax compare to

Q63: How can the positive AMT adjustment for

Q83: On July 17, 2017, Kevin places in

Q102: Which of the following statements is correct

Q119: The domestic production activities deduction (DPAD) for

Q120: If Abby's alternative minimum taxable income exceeds

Q149: Section 212 expenses that are related to