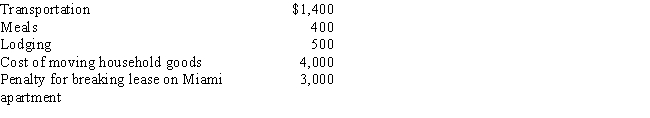

Due to a merger, Allison transfers from Miami to Chicago. Under a new job description, she is reclassified from employee to independent contractor status. Her moving expenses, which are not reimbursed, are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

Definitions:

Organizational Practices

Encompasses the procedures, methods, and routines used by an organization to achieve its objectives.

Rumours

Unverified information or stories that are spread among people, often lacking clear evidence, and can influence perception and behavior.

Non-verbal Communication

The process of conveying a message without the use of words, including gestures, facial expressions, and body language.

Jargon

Specialized language used by job holders or members of particular occupations or organizations.

Q3: On May 30, 2016, Jane purchased a

Q65: Tad and Audria, who are married filing

Q73: On May 2, 2017, Karen placed in

Q85: Pat purchased a used five-year class asset

Q88: Georgia had AGI of $100,000 in 2017.

Q103: Are there any circumstances under which lobbying

Q116: If an account receivable written off during

Q131: Sue files a Schedule SE with her

Q145: Discuss the 2%-of-AGI floor and the 50%

Q149: Which, if any, of the following is