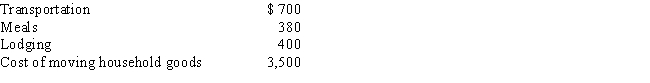

After graduating from college, Clint obtained employment in Omaha. In moving from his parents' home in Baltimore to Omaha, Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Definitions:

Healthy Diet

A nutritional regimen that provides all the necessary nutrients in the right amounts and proportions for maintaining health and well-being.

Type 2 Diabetes

A persistent disorder that impacts how the body handles blood glucose, marked by a resistance to insulin.

Common Type

Typically refers to the most frequently occurring form or category within a broader group.

Alzheimer's Disease

A progressive neurodegenerative disorder characterized by memory loss, cognitive decline, and personality changes.

Q3: Sandra sold 500 shares of Wren Corporation

Q11: Brad, who would otherwise qualify as Faye's

Q23: If the regular income tax deduction for

Q62: Bobby operates a drug trafficking business. Because

Q77: Which of the following expenses, if any,

Q88: C corporations are not required to make

Q90: On June 1, 2017, Irene places in

Q92: Taylor performs services for Jonathan on a

Q98: Qualified moving expenses include the cost of

Q167: For the current football season, Tern Corporation