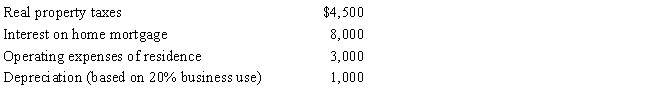

Rocky has a full-time job as an electrical engineer for the city utility. In his spare time, Rocky repairs TV sets in the basement of his personal residence. Most of his business comes from friends and referrals from former customers, although occasionally he runs an ad in the local suburbia newspaper. Typically, the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.The floor space of Rocky's residence is 2,500 square feet, and he estimates that 20% of this is devoted exclusively to the repair business (i.e., 500 square feet). Gross income from the business is $13,000, while expenses (other than home office) are $5,000. Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business

a.If he uses the regular (actual expense) method of computing the deduction for office in the home?

b.If he uses the simplified method?

Definitions:

Communication Monitoring

The practice of observing and evaluating one's own communication behaviors and strategies to enhance personal effectiveness and interpersonal relations.

Psychometric Assessments

Tools used to measure an individual's mental capabilities and behavioral style.

S.M.A.R.T.S System

No definitive definition, could imply a specific structured methodology aimed at achieving objectives, not a widely recognized acronym.

Stretchable

Refers to something capable of being stretched or made to cover a larger area or volume without tearing or breaking.

Q8: A scholarship recipient at State University may

Q8: Janice, single, had the following items for

Q18: If a business debt previously deducted as

Q27: Jon owns an apartment building in which

Q41: The IRS will issue advanced rulings as

Q53: Martin is a sole proprietor of a

Q59: The AMT adjustment for research and experimental

Q96: When is a taxpayer's work assignment in

Q98: Qualified moving expenses include the cost of

Q113: Dale owns and operates Dale's Emporium as