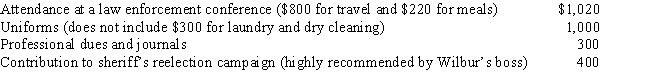

For the current year, Wilbur is employed as a deputy sheriff of a county. He has AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Definitions:

Vicarious Liability

Refers to a legal principle where an entity (such as an employer) can be held responsible for the actions or omissions of another person (like an employee), under certain conditions.

Sole Proprietorships

A business structure where a single individual owns, manages, and is personally responsible for all aspects of the business.

Ratified Inadvertently

Approved or confirmed accidentally or without the full intention to do so.

Full Disclosure

The obligation to reveal all relevant details of a transaction.

Q8: Gambling losses may be deducted to the

Q15: A theft loss is taken in the

Q23: A taxpayer may not deduct the cost

Q44: The stock of Eagle, Inc. is owned

Q59: Sammy, a calendar year cash basis taxpayer

Q85: Nondeductible moving expense

Q97: In some cases it may be appropriate

Q121: James is in the business of debt

Q154: A statutory employee is not a common

Q166: Bob lives and works in Newark, NJ.