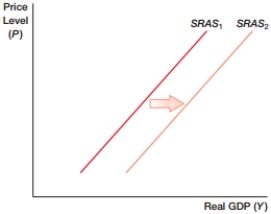

(Figure: SRASA) In the figure, what will cause the shift from SRAS1 to SRAS2?

Definitions:

Tax Incidence

The study of who ultimately bears the burden of a tax, which can differ from who the tax is initially levied upon.

Tax Burden

The measure of taxes that an individual or business must pay out of their income or profit.

Tax Incidence

The analysis of the effect of a particular tax on the distribution of economic welfare among entities in the market.

Imported Wine

Wine that is produced in one country and then shipped to and sold in another country.

Q17: The following data are for Econia during

Q27: The theory that a given change in

Q35: In 1997, the British government suddenly announced

Q46: Keynes assumed that the price level is

Q47: The idea that households spend each year

Q53: (Table 3: Macroeconomic Data for Country

Q71: To try to stimulate aggregate demand to

Q82: In the late 1960s, Milton Friedman and

Q87: How is quantitative easing different from ordinary

Q94: _ are government policies that are designed