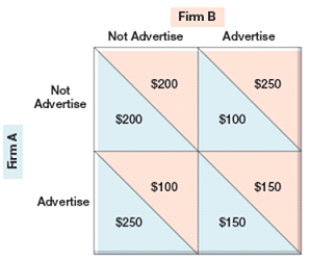

(Figure: Simultaneous Move Games 2) In the figure, if Firm A does not advertise and Firm B also does not advertise, Firm B's payoff is:

Definitions:

Strike Price

The price at which a derivative contract can be exercised, specifically referring to the price at which the holder of an option can buy (call option) or sell (put option) the underlying asset.

Listed Options

Contracts traded on a stock exchange that give buyers the right, but not the obligation, to buy or sell a security at a specified price within a certain time period.

Post Margins

The practice of depositing collateral to cover potential losses in trading accounts, especially in futures and options markets.

Naked Listed Options

Options contracts that are sold without owning the underlying asset, posing a higher risk due to the potential for unlimited losses.

Q19: Anthony uses $10,000 from his savings (earning

Q32: In perfect price discrimination, marginal revenue equals:<br>A)

Q33: _ is the percentage of the population

Q44: (Figure: Revenue Schedule) Demand and Marginal

Q51: In perfect competition, long-run equilibrium is achieved

Q56: Costs that have already occurred or been

Q72: Real-world outcomes of the ultimatum game indicate

Q79: _ for most of the increases in

Q81: (Figure: Labor in a Competitive Market 0)

Q86: In a decreasing cost industry, as firms