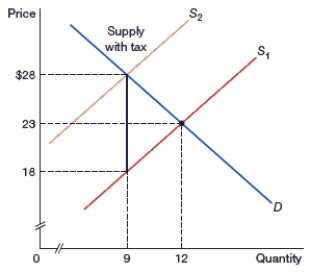

(Figure: An Excise Tax on Sellers) In the figure, what is the quantity demanded before the tax is applied?

Definitions:

Moving Expenses

Previously deductible expenses for moving which are necessary for starting a new job, currently only deductible for members of the Armed Forces on active duty moving under orders.

Separate Maintenance

Payments made by one spouse to another under a separation agreement, not classified as alimony for tax purposes.

Married Filing Separately

A taxation status allowing married individuals to submit separate tax returns, detailing their own earnings, deductions, and exemptions independently.

Moving Expense Distance

The minimum distance the new workplace must be from the taxpayer's old home to qualify moving expenses as deductible, according to IRS rules.

Q17: Consumers with a fixed budget will make

Q22: Firm XYZ produces paper products, which cost

Q44: A corporation has 2 million shares of

Q67: In _ cost industry, the entry of

Q78: (Figure: Total Utility and Marginal Utility) In

Q79: Economists derive inferences about utility based on:<br>A)

Q80: (Figure: The Price Elasticity of Demand) Using

Q83: A good for which demand increases as

Q90: If yachts that are priced over $100,000

Q104: Which of the following products are generally