Use the following information

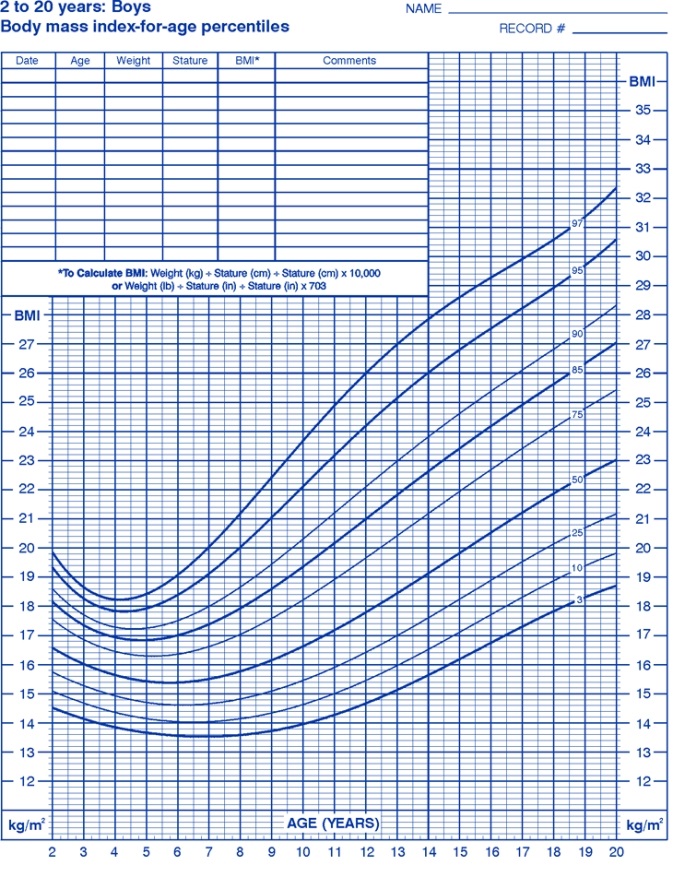

A 5-year-old boy is brought in for a nutrition assessment and health check.He weighs 50 lb (22.7 kg) ,and is 45 in (114 cm) tall.

-What does this boy's BMI mean?

Definitions:

Reference Check

The process of contacting a job applicant's previous employers, colleagues, or other references to verify the accuracy of the information provided by the applicant and to gain insights into their performance and behavior.

Video Interviews

A method of conducting job interviews using video conferencing tools, allowing for remote assessment and interaction between candidates and recruiters.

Cost-Effectiveness

An evaluation metric to determine the best way to achieve the desired outcome with the least use of resources, often used in financial and programmatic decision making.

Job Sample Tests

Assessment tools used in the recruitment process, where candidates are asked to perform tasks or work activities that reflect the job's actual demands to evaluate their suitability.

Q14: Which of the following would NOT be

Q26: MyPlate tips for an active preschooler include

Q36: If 400 IU vitamin E is likely

Q41: Approximately _ of term infants will become

Q45: In-depth nutrition assessments make sure nutrition is

Q45: Body mass index calculations account for gender

Q45: The preschool-age child should eat the same

Q49: Does this diet have an adequate amount

Q52: Approximately _ of adults over 75 found

Q58: If a 110-lb nursing woman (50 kg)wants