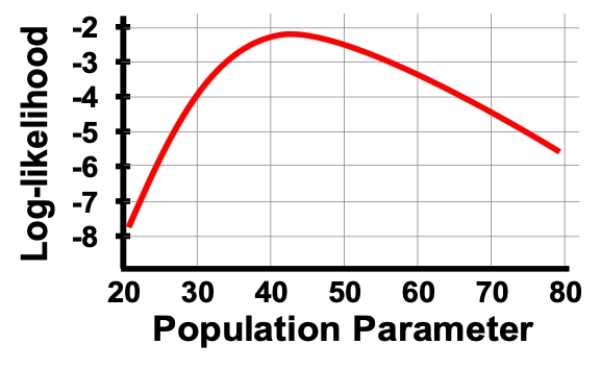

In the log-likelihood figure shown, which of the following ranges best matches the 95% confidence interval for the values on the X-axis?

Definitions:

Perpetual EBIT

Illustrates a theoretical concept where a company's earnings before interest and taxes (EBIT) are assumed to continue indefinitely.

Unlevered Cost of Capital

The cost of capital for a company that has no debt, representing the risk of a firm's assets before the impact of financial leverage.

Financial Leverage

Use of borrowed funds to increase the potential return of an investment, also indicating how much a company relies on debt to finance its assets.

Static Theory of Capital Structure

A financial hypothesis that suggests there is an optimal capital structure for a company where the cost of capital is minimized, and the value of the firm is maximized.

Q1: You are a junior-level PR staffer for

Q1: It is possible for the standard deviation

Q2: Consider the two data sets shown.

Q9: The public information model of public relations

Q11: A χ<sup>2</sup> goodness-of-fit test that results in

Q26: Imagine we are catching fish from a

Q26: When sample sizes are large and all

Q30: One patient dropped out of the study.

Q31: What is the 95% confidence interval for

Q54: Using extrapolation to predict Y values outside