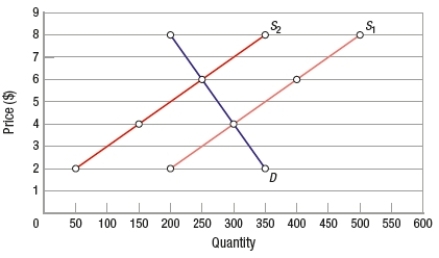

(Figure: Determining Tax Burdens) Based on the graph, the tax incidence

Definitions:

Real GDP

An inflation-adjusted measure that reflects the value of all goods and services produced by an economy in a given year, expressed in base-year prices, to reveal the true growth rate.

Intermediate Good

A product used to produce a final good or finished product, also known as a semi-finished product.

Direct Tax

Tax on a particular person. Most important are federal personal income tax and payroll (Social Security) tax.

Excise Tax

A tax imposed on specific goods, services, or transactions, often included in the price of products like gasoline, alcohol, and tobacco, aimed at reducing their consumption or raising revenue.

Q6: The SEC places restrictions on what a

Q30: _ is a form of financing that

Q33: Which of the following statements is true?<br>A)

Q43: When considering self-funding, carefully consider how much

Q44: Which of the following should you NOT

Q49: The breakeven point is the level of

Q77: Taxes on spending make up a larger

Q174: Goods that are normally consumed together, such

Q289: In Virginia, people buy more strawberries in

Q312: In general, as the price of a