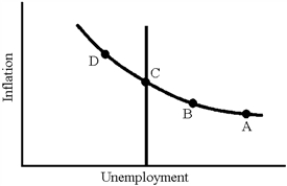

Figure 17-7

-In Figure 17-7, the only sustainable long-run equilibrium position is at point

Definitions:

Asset/Liability Method

A method used in accounting to adjust the books for tax purposes, balancing the future tax benefits of assets against the future tax obligations of liabilities.

Accelerated Cost Recovery

A method of depreciation used for tax purposes that allows for higher deductions in the early years of an asset's life.

Straight-Line Depreciation

Straight-Line Depreciation is a method where the cost of a tangible asset is reduced evenly over its useful life.

Deferred Tax Income Tax

A tax liability or asset that arises due to temporary differences between the financial reporting and tax bases of assets and liabilities.

Q31: Figure 18-10 shows the effect on the

Q35: Which of the following led to the

Q72: What does it mean to "monetize the

Q142: An economy eliminates a recessionary gap by

Q144: Lately,the ratio of debt to GDP has

Q185: Specialization is the concept of devoting resources

Q194: A country with an undervalued currency<br>A) will

Q194: If economic fluctuations originate on the supply

Q211: How rapidly does the economy's self-correcting mechanism

Q215: If two countries have production possibilities curves