Use this information to answer the following questions.

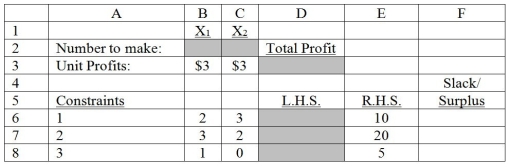

Consider the following product mix problem and its associated spreadsheet model.

-Refer to the spreadsheet above.Which equation should be entered in cell F6 to compute the unused resources of constraint #1?

Definitions:

Worry

A mental state involving feelings of anxiety and concern, often focused on negative or uncertain outcomes.

Atheoretical

Not based on or concerned with a particular theory.

Abnormal Behaviour

Actions or patterns of behavior that deviate significantly from societal or cultural norms, potentially leading to distress or dysfunction.

Clinician Intuition

The instinct or innate knowledge clinicians use to understand or predict patient behaviors and outcomes, often based on experience.

Q2: Summarize the position of labor unions in

Q14: Consider the following PERT network,along with

Q15: Which of the following external recruitment techniques

Q18: _ is a physical demand stressor.<br>A) Group

Q22: What is the constraint associated with

Q30: Which of the following theories addresses the

Q30: Which of the following is a characteristic

Q33: Refer to Scenario 7.1.Which of the following

Q38: By how much would the profit contribution

Q39: A local ice cream shop sells 10,000