Use This Information to Answer the Following Questions -Use the Sensitivity Report to Answer the Following Questions:

A

Use this information to answer the following questions.

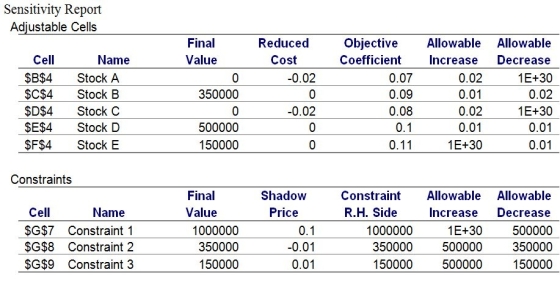

An investment company currently has $1 million available for investment in five different stocks.The company wants to maximize the interest earned over the next year.The five investment possibilities along with the expected interest earned are shown below.To manage risk,the investment firm wishes to have at least 35% of the investment in stocks A and B.Furthermore,no more than 15% of the investment may be in stock E.

-Use the Sensitivity Report to answer the following questions:

a.What is the optimal total expected interest earned for next year?

b.What is the dollar amount that should be invested in each stock?

c.Which constraints are binding? Which constraints are not binding?

d.Is the solution to the problem unique or are there alternate optimal solutions?

e.Does the optimal solution call for investing the entire $1,000,000?

Definitions:

Paid in Full

A term indicating that a bill or a debt has been completely paid off and no amount remains due.

Full Balance

This term could refer to the complete settling of a financial account, leaving no outstanding balance.

Endorsement

Official approval or support, often used in the context of public approval by a prominent figure or certification by a regulatory authority.

Date and Time Stamp

A digital or physical mark indicating the specific date and time when an event occurred or a document was created, modified, or received.

Q1: Cycles,one of the components of time series,is

Q2: John Smith is planning to refinance his

Q4: A company that is introducing a

Q6: A manufacturer of 19" LCD monitors encounters

Q10: The Economic Production Quantity (EPQ)model assumes instantaneous

Q13: Explain how a management and a labor

Q31: A company can decide how many additional

Q35: Use the Sensitivity Report to answer the

Q41: Executive Order 11246 requires that federal contractors

Q45: Briefly describe goal theory.