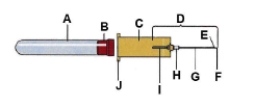

Identify the lettered item on the following figure.

D: ____________________

Definitions:

Investment

The process of distributing funds with the aim of earning revenue or gains.

Imports

Goods or services brought into a country from abroad for sale, typically requiring payment to the origin country or entity.

Sole Proprietorship

A business structure where a single individual owns, manages, and is personally responsible for all aspects of the business, including liabilities.

Liability

A legal obligation or debt that an entity is required to pay to another.

Q5: Which laboratory department tests the cellular components

Q22: Which of the following statements is false?<br>A)

Q31: You can use a picture that you

Q38: Which of the following sites could be

Q39: Which is the correct statement regarding patient

Q39: An image can be resized by using

Q54: Research on the effectiveness of moral appeals

Q62: Which of the following sanctions is characterized

Q89: When creating handouts in Microsoft Word, the

Q109: Which of the following is the most