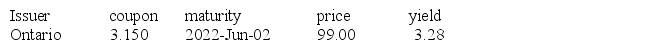

Given the following bond information:

What would be the taxable income on this bond if it were purchased at this price on June 1st and sold December 1st for a price of 103.00 and has face value of $20 000 and a semi-annual coupon payment?

Definitions:

Segment Revenues

The income generated from specific divisions or operational units within a company, allowing for the analysis of each segment's contribution to the overall revenue.

Operating Expenses

Costs associated with running a business's core operations excluding the cost of goods sold, such as rent, utilities, and payroll.

Reportable Segments

This refers to distinct components of a business for which separate financial information is available and is regularly reviewed by the company's decision-makers.

Interest Revenue

Income earned by a company from its lending activities or from holding interest-bearing financial assets.

Q2: Old Age Security can be deferred for

Q4: Mortgage life insurance is usually the best

Q6: Which of the following will decrease your

Q22: An income trust<br>A)pays taxes on its earnings

Q56: A margin call is a request from

Q74: If Jack has a $3000 credit card

Q80: If you had lived in Canada for

Q80: Decoding occurs when the message is interpreted

Q84: The best assessment of the performance of

Q87: A company has a choice of whether