Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

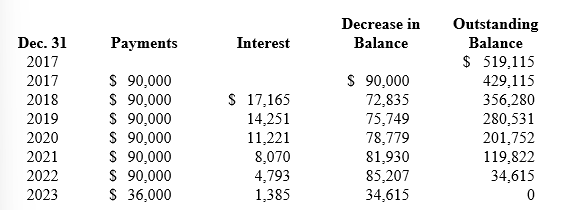

Reagan's lease amortization schedule appears below:

-In this situation, Reagan:

Definitions:

Regular Time Cost

The cost associated with normal operating hours or work performed during standard working times, excluding overtime or premium pay rates.

Varying Inventory Levels

Adjusting the amount of stock on hand to meet changing demand conditions or to maximize operational efficiency.

Back Ordering

Refers to the process of accepting and processing orders for currently out-of-stock goods to be fulfilled when the stock is replenished.

Services

Activities or benefits provided to consumers or businesses that do not result in the ownership of tangible goods.

Q27: Which of the following differences between financial

Q49: The information below pertains to Mondavi Corporation:<br>(a.)

Q58: Trussel Creations leased kitchen equipment under a

Q69: For the current year ($ in millions),

Q74: Peters Company leased a machine from Johnson

Q124: A short-term lease:<br>A) Must be accounted for

Q149: An employer reports a pension loss when:<br>A)

Q173: Gore Company, organized on January 2, 2018,

Q175: Wainwright Ropes leased high-tech electronic equipment

Q243: Maker Corp. manufactures imaging equipment. Easy Leasing