Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

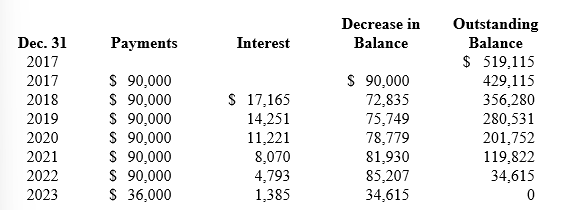

Reagan's lease amortization schedule appears below:

-At what amount would Reagan record the right-of-use asset at the beginning of the agreement?

Definitions:

Indorsements

In finance, refers to the act of signing the back of a negotiable instrument, such as a check, thereby transferring ownership or authorizing another action related to the instrument.

Legal Implications

The potential legal consequences or effects that actions or decisions can have under the law.

Deposit Only

A deposit only account is a type of bank account where funds can be deposited but not directly withdrawn by the account holder, typically used for specific purposes like settling transactions.

Indorsed in Blank

Pertains to a signature on a financial instrument, such as a check, without specifying a payee, allowing any holder to cash or transfer it.

Q3: The tax benefit of a net operating

Q61: On March 31, 2018, Ashley, Inc.'s bondholders

Q78: National Leasing leases equipment to a variety

Q90: Python Company leased equipment from Hope

Q119: Subordinated debenture<br>A)No specific assets pledged<br>B)Legal, accounting, printing<br>C)Protection

Q119: C Corp., a lessee, has a rate

Q123: A deferred tax asset represents a:<br>A) Future

Q150: On December 31, 2018, Bedford Corp. sold

Q201: What is the effective annual interest rate?<br>A)

Q220: The difference between pension plan assets and