Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

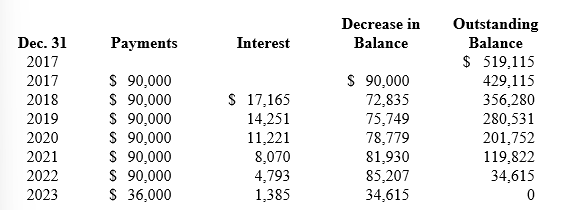

Reagan's lease amortization schedule appears below:

-What is the effective annual interest rate charged to Reagan on this lease?

Definitions:

Josef Breuer

An Austrian physician whose work in the 1880s with patient Anna O. led to the development of psychoanalysis.

Sigmund Freud

An Austrian neurologist known for founding psychoanalysis, a clinical method for treating psychopathology through dialogue between a patient and a psychoanalyst.

Hypnotism

The practice of inducing a trance-like state in which a person is more susceptible to suggestion.

Psychoanalytic Treatment

A therapeutic process rooted in Freudian theory that seeks to explore and understand unconscious thoughts and behaviors through techniques like dream analysis and free association.

Q36: Griggs Co. failed to amortize the premium

Q51: What amount of accrued interest payable

Q78: National Leasing leases equipment to a variety

Q123: When bonds are sold at a premium

Q127: Pocus Inc. reports warranty expense when related

Q134: Retained earnings<br>A)May be increased when net income

Q156: Required: How much interest will Morton Sales

Q167: What is the interest expense on

Q235: Discuss the financial statement disclosure requirements for

Q246: A sales-type lease is reported in the