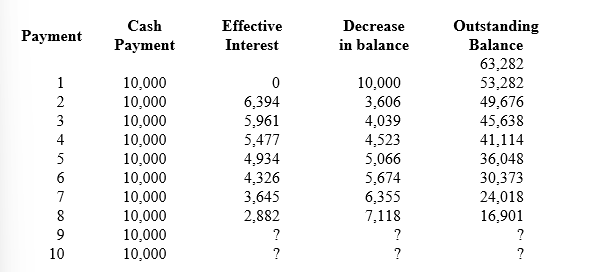

Refer to the following lease amortization schedule. The 10 payments are made annually starting with the beginning of the lease. Title does not transfer to the lessee and there is no purchase option or guaranteed residual value. The asset has an expected economic life of 12 years. The lease is noncancelable.

-When a lease qualifies as a finance lease, what amount is recorded as the cost of the right-of-use asset?

Definitions:

Recognized

Acknowledged or understood, often referring to income, gains, or losses for tax purposes.

Distribution

Withdrawals or payouts from investments, retirement accounts, or revenue from a business that may be taxable.

Current Cash Distribution

In investments, it refers to the actual cash distributed to investors or partners from the operations of a business, fund, or another form of investment.

Partnership Interest

An owner's share of the profits and losses, and rights and obligations, in a partnership.

Q25: In a ten-year installment note, the portion

Q29: Prior service cost<br>A)Caused by plan amendment.<br>B)Causes a

Q33: What is the difference between a stock

Q68: Recognizing tax benefits in a loss year

Q110: A bargain purchase option is defined as

Q138: Pension expense and funding amounts are both

Q140: A gain from changing an estimate regarding

Q175: On January 1, 2018, Solo Inc. issued

Q182: On January 1, 2018, Tennessee Valley Corporation

Q240: According to generally accepted accounting principles, accounting