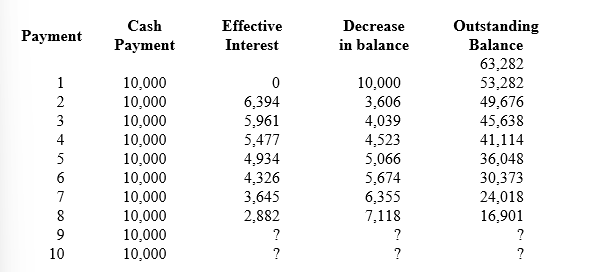

Refer to the following lease amortization schedule. The 10 payments are made annually starting with the beginning of the lease. Title does not transfer to the lessee and there is no purchase option or guaranteed residual value. The asset has an expected economic life of 12 years. The lease is noncancelable.

-For a finance lease, an amount equal to the present value of the lease payments should be recorded by the lessee as a(n) :

Definitions:

Fixed Overhead Budget Variance

The difference between the budgeted fixed overhead costs and the actual fixed overhead incurred.

Fixed Costs

Costs that do not change with the level of production or sales, such as rent, salaries, and insurance premiums, providing predictability to a business's expenses.

Labour Efficiency Variance

The difference between the actual hours worked and the standard hours expected to produce a certain level of output, valued at the standard labour rate.

Credit Balance

An account balance that shows money owed to the account holder, often indicating a creditor position in financial records.

Q24: Revenues from installment sales of property reported

Q104: Pocus, Inc., reports warranty expense when related

Q118: What is the interest cost to be

Q129: Differentiate between a defined contribution pension plan

Q144: The component of pension expense that results

Q146: If the leaseback portion of a sale-leaseback

Q151: In a ten-year finance lease agreement, the

Q152: An operating loss carryback.<br>A)L<br>B)N<br>C)A

Q160: Postretirement health care<br>A)The portion of the EPBO

Q177: Lasagna Corporation has a defined benefit