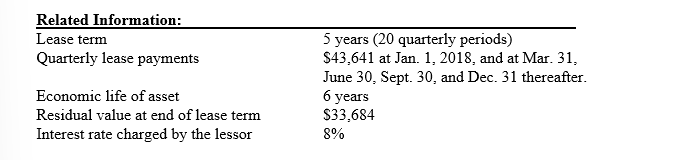

Charles River Hospital leased medical equipment from Plymouth Industries on January 1, 2018. Plymouth Industries manufactured the equipment at a cost of $600,000. The equipment has a fair value of $750,654. Appropriate adjusting entries are made quarterly.

Required:

Round your answers to the nearest whole dollar amounts.

1. Prepare appropriate journal entries for Charles River Hospital to record the arrangement at its commencement, January 1, 2018, and on March 31, 2018.

2. Prepare appropriate journal entries for Plymouth Industries to record the arrangement at its commencement, January 1, 2018, and on March 31, 2018.

Definitions:

Activity Depreciation Method

A method of calculating the depreciation of an asset based on its usage, activities, or units of production rather than the passage of time.

Depreciation Expense

The allocated reduction in the carrying amount of a tangible asset over its useful life, reflecting wear and tear, obsolescence, or other declines in value.

Estimated Life

The anticipated duration for which an asset is expected to be functional and economically viable, dictating its depreciation schedule.

Group Depreciation

A depreciation strategy applied to a collection of assets that have similar characteristics and useful lives, simplifying the process of calculating depreciation expenses.

Q28: On January 1, 2018, Ozark Minerals issued

Q50: On January 1, 2018, Duncan-Lang Services, Inc.

Q57: Assuming no other deferred tax items exist

Q59: Financial statement disclosure of the components of

Q64: A line of credit is an agreement

Q67: Amber Inc. is one of the largest

Q114: On June 30, 2018, K Co. had

Q212: On May 1, 2018, Green Corporation issued

Q223: Most corporate bonds are:<br>A) Mortgage bonds.<br>B) Debenture

Q238: On February 1, 2018, Fox Corporation issued