Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

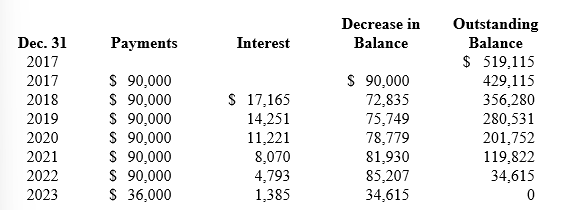

Reagan's lease amortization schedule appears below:

-In this situation, Reagan:

Definitions:

Governmental Contracts

Agreements entered into by government agencies with private entities or individuals for the supply of goods, services, or the undertaking of works.

Offerees

Individuals or entities to whom an offer is made, which they can either accept or reject.

Present Intent

A legal term referring to an individual's current intention to perform an act or designate a legal status, crucial for the validity of certain legal documents and transactions.

Definiteness

A characteristic of a contract that requires its terms to be clear enough for the parties involved to understand their obligations and rights.

Q6: GAAP regarding accounting for income taxes requires

Q74: <br>What should be the balance in Kent's

Q93: From the perspective of the lessee, leases

Q109: Income tax expense<br>A)No tax consequences.<br>B)Produces future taxable

Q176: Mind Explorers issues bonds with a stated

Q185: Assuming that Auerbach issued the bonds for

Q208: Premium on bonds<br>A)Market rate higher than stated

Q214: The three components of pension expense that

Q247: On February 1, 2018, Wolf Inc. issued

Q255: Bonds will sell for a premium when