Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

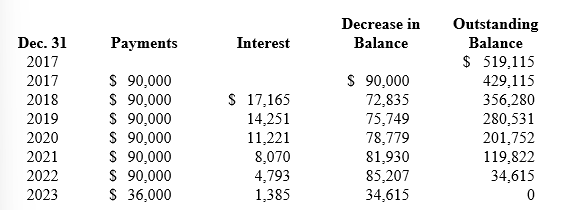

Reagan's lease amortization schedule appears below:

-What is the balance of the lease liability on Reagan's December 31, 2019, balance sheet (after the third lease payment is made) ?

Definitions:

Just Compensation

The fair payment required to be made to an individual when their property is taken for public use, as guaranteed by the Constitution.

Zoning Rights

Legal permissions dictating the use of land in specific areas according to designated categories such as residential, commercial, or industrial.

Real Property

Land and anything permanently attached to it, such as buildings or trees.

Physical Property

An attribute of a physical system or body; commonly refers to properties like mass, volume, and density that can be observed and measured without changing the substance itself.

Q1: A customer advance produces a liability that

Q14: What is Havana's 2018 gain or loss

Q42: Blue Co. recorded a right-of-use asset of

Q69: Neely BBQ leased equipment from Smoke Industries

Q69: <br>What is the present value of Ralph's

Q86: <br>Ignoring operating expenses and additional sales in

Q86: When bonds include detachable warrants, what is

Q93: Assuming no other relevant data exist, what

Q162: When bonds and other debt are issued,

Q163: During its first year of operations, Cole's