Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

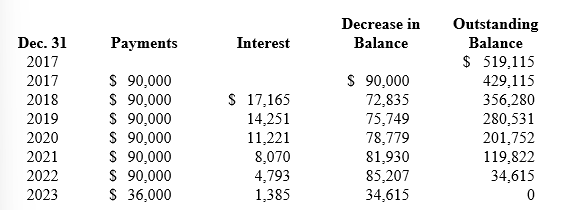

Reagan's lease amortization schedule appears below:

-What is the effective annual interest rate charged to Reagan on this lease?

Definitions:

Cholesterol

A waxy, fat-like substance found in all cells of the body, important for making hormones, vitamin D, and substances that help digest foods.

Steroids

A class of lipid molecules that includes hormones, vitamins, and cholesterol, which serve various functions in organisms.

Phospholipids

A class of lipids that are a major component of all cell membranes, containing two fatty acids, a phosphate group, and a glycerol molecule.

Polymer

Macromolecule consisting of covalently bonded monomers; for example, a polypeptide is a polymer of monomers called amino acids.

Q4: Discuss the accounting for postretirement benefits prior

Q14: Hy Marx Co. recorded a right-of-use asset

Q78: Interest cost<br>A)The portion of the EPBO attributed

Q94: Travis Transportation reported a net loss-AOCI in

Q100: For reporting purposes, current deferred tax assets

Q105: Why do companies find the issuance of

Q124: A short-term lease:<br>A) Must be accounted for

Q129: What amount of interest revenue from the

Q152: Bonds payable should be reported as a

Q246: Amortizing a net loss for pensions will:<br>A)