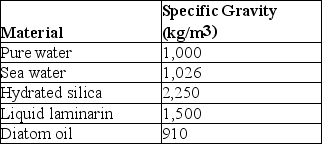

The next few questions refer to the following description and table.

Diatoms are encased in Petri-platelike cases (valves) made of translucent hydrated silica whose thickness can be varied. The material used to store excess calories can also be varied. At certain times, diatoms store excess calories in the form of the liquid polysaccharide, laminarin, and at other times as oil. The following are data concerning the density (specific gravity) of various components of diatoms, and of their environment.

Specific Gravities of Materials Relevant to Diatoms

-Judging from the table and given that water's density and, consequently, its buoyancy decrease at warmer temperatures, in which environment should diatoms (and other suspended particles) sink most slowly?

Definitions:

S Corporation

A designation for a corporation that meets specific Internal Revenue Service criteria, allowing it to be taxed as a pass-through entity, thereby avoiding the double taxation typically applied to corporations.

Purported Partnership

The appearance of partnership when there is no partnership; it arises when a person misleads a second person into believing that the first person is a partner of a third person; a theory that allows the second person to recover from the first person all reasonable damages the second person has suffered due to his reliance on the appearance of partnership.

Constructive Partnership

A legal concept where a partnership is deemed to exist based on the actions or conduct of the parties, despite there being no formal agreement.

Actual Partnership

A type of business partnership that exists when two or more individuals engage in a business for profit with an express or implied agreement of partnership, as opposed to being legally deemed partners by the law.

Q5: The existence of the phenomenon of exaptation

Q20: Evidence indicates that plants increase the number

Q32: Evolution includes all of the following points

Q36: At which developmental stage should one be

Q37: Humans have immune systems in which lymph

Q40: What makes it risky to rely on

Q52: Which of these fly organs,as they exist

Q54: Assuming the existence of fossilized markers for

Q66: One morphological feature of modern cetaceans is

Q83: Structurally,phragmoplasts should be most similar to<br>A)the nuclear