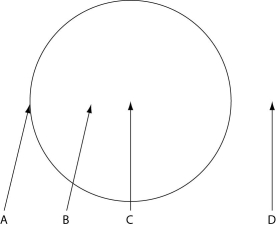

The following figure depicts the outline of a large fairy ring that has appeared overnight in an open meadow, as viewed from above. The fairy ring represents the furthest advance of this mycelium through the soil. Locations A-D are all 0.5 meters below the soil surface. Responses may be used once, more than once, or not at all.

-Assume that all four locations are 0.5 m above the surface. On a breezy day with prevailing winds blowing from left to right, where should one expect to find the highest concentration of free basidiospores in an air sample?

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, representing the increase in tax payment for every additional dollar earned.

Taxable Income

The portion of an individual or entity's income upon which taxes are levied by the government, after all deductions and exemptions are factored in.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by the total income.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating how much of any additional income will be paid in taxes.

Q6: The evolution of animal species has been

Q12: If infection primarily involves the outermost layers

Q12: It was once thought that cetaceans had

Q24: You are given an unknown organism to

Q25: Which of the following is not an

Q32: Female birds lay their eggs,thereby facilitating flight

Q64: In what structures do both Penicillium and

Q69: What does recent evidence from molecular systematics

Q76: Which cells are no longer capable of

Q81: Evidence of which structure or characteristic would