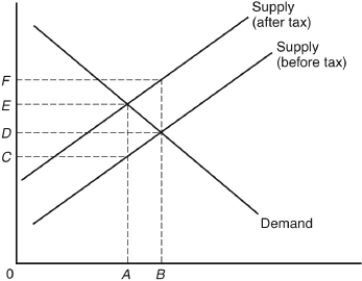

The following question are based on the following diagram:

-The amount of tax shifted onto the seller is best illustrated by

Definitions:

Good Substitutes

Products or services that can be used in place of each other, having a high cross-elasticity of demand.

Income Elasticity Coefficient

A measure indicating how much the quantity demanded of a good responds to change in consumer income.

Recessions

Periods of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in successive quarters.

Income Elasticity

A measure of how much the demand for a product or service changes in response to changes in consumer income.

Q4: Deviations in national output around potential output

Q10: The 2011 U.S.per capita income was about<br>A)

Q12: Many of the basic innovations introduced into

Q17: In 2012,a household with an annual income

Q27: If the money supply is fixed,decreases in

Q44: A mandatory neighborhood recycling program is an

Q51: Ricardo,in his work on income distribution,emphasized the

Q60: Educational expenditures may be viewed as an

Q66: Transfer payments are payments<br>A) by individuals of

Q68: Which of the following is the best