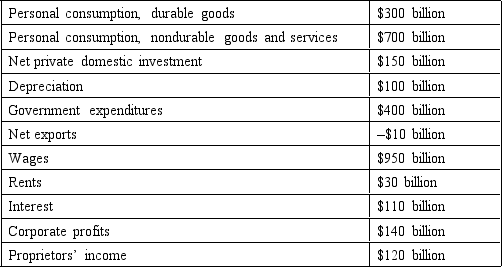

The following question are based on the following information about a hypothetical economy:

-Indirect taxes are

Definitions:

Sample

A subset of a population selected for observation and analysis.

Population

The total set of individuals, items, or data points that are of interest in a statistical analysis, from which samples may be drawn for study.

Descriptive

Descriptive refers to the statistical techniques or studies that aim to summarize or describe a set of data without making inferential predictions or determinations about the data.

Nominal

Describing a data classification that categorizes data without a natural order or ranking.

Q7: A significant source of revenue for the

Q7: The need for barter is eliminated when

Q10: Wage differentials that persist in labor markets

Q12: One reason for rejecting the argument that

Q19: If the required ratio of reserves to

Q25: Unemployment compensation and welfare payments tend to

Q54: In the long run,the aggregate supply curve

Q60: Since World War I,the highest unemployment rates

Q69: A change in investment spending NOT caused

Q72: The peak of the cycle is best