Multiple Choice

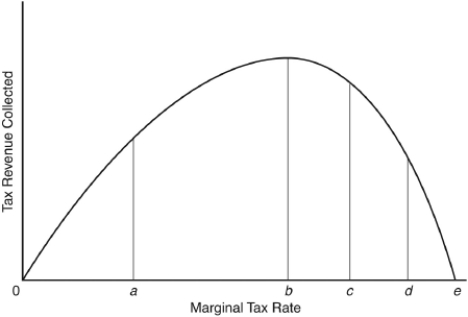

The following question are based on the following Laffer curve:

-Advocates of supply-side tax reductions,such as a reduction in the capital gains tax,argue that these taxes currently have marginal tax rates that are

Definitions:

Related Questions

Q5: According to the more sophisticated quantity theory

Q25: After this process has worked its way

Q27: An unfavorable supply shock<br>A)shifts aggregate demand to

Q31: Supply-side inflation<br>A) generally occurs during periods of

Q31: The slope of the consumption function is

Q42: The difference between tax revenues and government

Q52: Country A must have an absolute advantage

Q57: The amount of money held for speculative

Q61: If the interest rate is 7 percent,the

Q66: In the debate between the monetarists and