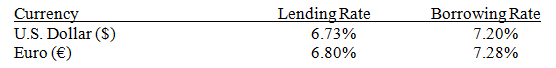

Assume the following information regarding U.S.and European annualized interest rates:

Milly Bank can borrow either $20 million or €20 million.The current spot rate of the euro is $1.13.Furthermore,Milly Bank expects the spot rate of the euro to be $1.10 in 90 days.What is Milly Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days

Definitions:

Sleepy

Feeling tired or drowsy, often with a desire or need to sleep.

Sleep Apnea

A sleep disorder characterized by pauses in breathing or periods of shallow breathing during sleep.

Breathing

The physiological process of inhaling and exhaling air to facilitate gas exchange, primarily oxygen intake and carbon dioxide expulsion.

REM Sleep

A phase of sleep characterized by rapid eye movements and is associated with dreaming and brain activity similar to wakefulness.

Q8: Apply the decision making model to this

Q25: _ represents any impact of exchange rate

Q30: _ purchases more U.S.exports than any other

Q36: Volusia,Inc.is a U.S.-based exporting firm that expects

Q37: An indirect benefit to the MNC of

Q39: When expecting a foreign currency to depreciate,a

Q47: Johnson,Inc.,a U.S.-based MNC,will need 10 million Thai

Q56: One argument for exchange rate irrelevance is

Q91: To improve your accuracy with self-assessments, all

Q102: Due to put-call parity,we can use the