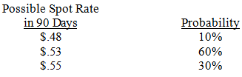

Assume that Jones Co.will need to purchase 100,000 Singapore dollars (S$) in 180 days. Today's spot rate of the S$ is $.50,and the 180day forward rate is $.53. A call option on S$ exists,with an exercise price of $.52,a premium of $.02,and a 180day expiration date. A put option on S$ exists,with an exercise price of $.51,a premium of $.02,and a 180day expiration date. Jones has developed the following probability distribution for the spot rate in 180 days:

The probability that the forward hedge will result in a higher payment than the options hedge is _______ (include the amount paid for the premium when estimating the U.S.dollars required for the options hedge) .

Definitions:

North American Free Trade Agreement

A trade agreement among the United States, Canada, and Mexico to reduce trade barriers and promote economic exchange.

Efficient Equilibrium

A state of balance in a market where resources are allocated in the most efficient way possible, with no room for welfare improvement without making someone else worse off.

Relative Price

The price of one good or service compared to another, usually indicating how much of one can be exchanged for the other.

Economic Outcome

The result of economic activities, often measured by metrics such as GDP growth, unemployment rates, and inflation.

Q2: Springfield Co.,based in the U.S.,has a cost

Q9: A U.S.firm plans to borrow Swiss francs

Q35: An example of crosshedging is:<br>A) find two

Q37: Regarding the valuation of privatized business in

Q39: The Multilateral Investment Guarantee Agency can provide

Q42: If an MNC exports to a country,then

Q43: Wisconsin Inc.conducts business in Zambia.Years ago,Wisconsin established

Q46: If a U.S.parent is setting up a

Q67: The writer of a call option is

Q71: Which of the following is true<br>A) Most