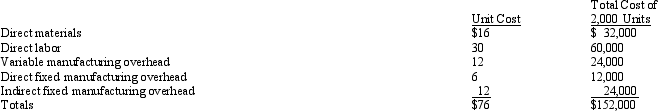

Exhibit 22-3 Shasta Company is operating at less than full capacity. The production manager is considering using this excess capacity to make a part that he usually buys. The full costs of manufacturing the part are as follows: Up to now, the company has been buying 2,000 units of the part for a total of $124,000.

Up to now, the company has been buying 2,000 units of the part for a total of $124,000.

Refer to Exhibit 22-3. If Shasta Company uses a differential-cost analysis in deciding whether to make the part, the total differential cost of making the part would be:

Definitions:

Return Requirement

The minimum expected return an investor requires from an investment to make it worthwhile, considering the risk involved.

Dividend Irrelevance Hypothesis

A theory suggesting that the dividend policy of a company is irrelevant to its market value, as long as the firm's investment and financing decisions are unchanged.

Larger Dividends

An increase in the amount of money paid out to shareholders from a company's earnings, typically reflecting its strong financial health or a strategy to return more capital to investors.

Selling Price

The amount of money for which an item or service is sold in the market.

Q8: The formula for economic value added is:<br>A)

Q11: Exhibit 20-1 The following information is for

Q44: The owner of the pizza parlor you

Q48: When comparing income statements, which type of

Q51: Refer to Exhibit 2-3. Given the above

Q65: When the variable cost ratio decreases, the:<br>A)

Q69: Which of the following will occur if

Q70: All of the following define capital EXCEPT:<br>A)

Q76: The labor efficiency variance is the difference

Q83: On April 1, Bonita Corporation's retained earnings