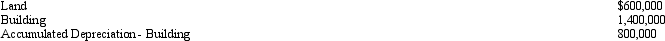

In 2002, Yates Company purchased land and a building at a cost of $2,000,000, with $600,000 allocated to land and $1,400,000 to the building. On December 31, 2011, the accounting records showed the following:

During 2012, it is determined that the building is on the site of a toxic waste dump and the future cash flows associated with the land and building are less than the recorded total book value for these two assets. The fair value of the land and building is $200,000, of which $60,000 is land. Make any journal entries necessary to record the asset impairment.

Definitions:

Fishbone Diagram

A visual tool used for identifying and organizing the causes of a problem, typically resembling the shape of a fishbone.

Causes

The underlying factors or reasons for an event or situation, often analyzed in problem-solving and decision-making processes.

The Law of Unintended Consequences

The principle that actions, especially those taken on a large scale, can have unanticipated and often undesirable effects.

Uncertainty

The state of having limited knowledge, making it impossible to precisely predict the future or outcomes.

Q30: If the ending inventory balance is understated,

Q34: Unger Sporting Goods Company sold a pair

Q46: Following are the account balances from the

Q49: Scott purchased 200 shares of Frozen Foods

Q54: Deuce Company uses the allowance method to

Q58: Which of the following factors are used

Q63: Todd purchased 600 shares of stock at

Q67: You want to purchase shares in a

Q75: The Zeus Company bond pays interest semi-annually.You

Q144: During a period of continuing inflation, which