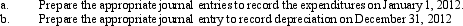

Whiting Company purchased a machine in 2007 for $150,000. The machine was being depreciated by the straight-line method over an estimated useful life of 10 years, with no salvage value. At the beginning of 2012, after 5 years of use, Whiting paid $30,000 on maintenance to the machine. Whiting determined that $5,000 of this expense was normal maintenance and did not extend the life of the machine. However, the rest of the expenditure was an overhaul of the machine and was expected to extend the machine's estimated useful life by an additional 5 years. What would be the depreciation expense recorded for the above machine in 2012?

Definitions:

Implementing

Refers to the process of putting plans or strategies into operation.

Creative Strategist

A professional who combines creative thinking with strategic analysis to develop innovative solutions or approaches.

Political Strategy

A plan of action designed to achieve a specific political outcome, often involving campaigns, communications, and resources allocation.

Policy Proposals

Policy proposals are formal suggestions or plans presented to address specific issues or challenges, outlining strategies and actions intended to shape or influence public policy decisions.

Q24: Charles Company sells foods wholesale. On May

Q29: Besides size,how else does a mutual fund

Q37: Claflin Construction Company purchased a machine on

Q45: Norton Company owns a machine that was

Q73: Which type of the major activities of

Q86: Eileen just sold a stock and realized

Q94: The perpetual method of accounting for inventory<br>A)

Q105: A depreciable asset's book value can never

Q115: Customers who do NOT pay for the

Q128: Four widely used methods of allocating the