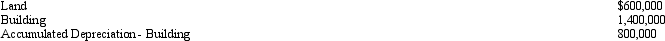

In 2002, Yates Company purchased land and a building at a cost of $2,000,000, with $600,000 allocated to land and $1,400,000 to the building. On December 31, 2011, the accounting records showed the following:

During 2012, it is determined that the building is on the site of a toxic waste dump and the future cash flows associated with the land and building are less than the recorded total book value for these two assets. The fair value of the land and building is $200,000, of which $60,000 is land. Make any journal entries necessary to record the asset impairment.

Definitions:

Medical Model

A framework for understanding diseases and disorders that emphasizes biological factors and physical processes.

Dieting

The practice of eating food in a regulated and supervised manner to decrease, maintain, or increase body weight, or to prevent and treat diseases.

Weight Control

The process of adopting long-term lifestyle changes to maintain a healthy body weight, often involving diet and physical activity.

Metabolism

The complex of life-sustaining chemical reactions in organisms that allows them to grow, reproduce, maintain their structures, and respond to environments.

Q6: Which statement best describes the role of

Q24: The Public Company Accounting Oversight Board<br>A) Establishes

Q26: Dike Corporation incurred the following losses during

Q47: On December 31, the trial balance of

Q57: The mean plus or minus one standard

Q57: Which of the following demonstrates that a

Q67: You want to purchase shares in a

Q71: The matching principle requires that<br>A) Cash outflows

Q75: You purchased 1,000 shares of stock at

Q81: You want to purchase a security that