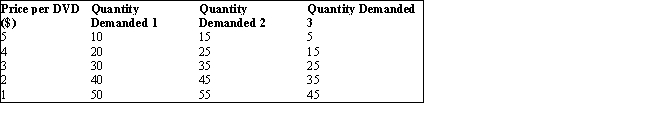

The table given below reports the quantity demanded of a good by individuals 1, 2, and 3 at different prices.Table 3.1

-Which of the following will have no impact on the demand for ice cream in the short run?

Definitions:

Premium Tax Credit

A refundable tax credit designed to help eligible individuals and families with low to moderate income afford health insurance purchased through the Health Insurance Marketplace.

Taxpayer Contribution Amount

The sum of money contributed by a taxpayer towards taxes, retirement accounts, or other eligible investments, potentially affecting tax calculations.

AGI

Adjusted Gross Income is gross income minus adjustments to income, serving as a key figure in determining taxable income and eligibility for certain tax benefits.

Qualifying Child

A dependent child who meets specific IRS criteria concerning age, relationship, residency, and support, allowing the taxpayer to claim certain tax benefits.

Q4: Ulysses bought Whiteacre from Gordon but never

Q20: If the parties involved agree that personal

Q27: If the price level in any country

Q35: In a market economy, _ own(s) all

Q45: Which of the following statements is true?<br>A)

Q55: How is recession defined by the National

Q72: The euro coins can be spent only

Q79: Refer to Table 5.3. The value added

Q83: Which of the following will result in

Q94: Which of the following illustrates an optimistic