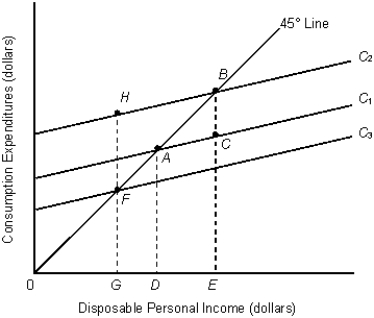

The figure given below shows the consumption functions of an economy.?Figure 9.4

-Refer to the Figure 9.4. If the economy is in equilibrium at A, which of the following is most likely to occur if consumers expect a period of rapid economic expansion?

Definitions:

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, thereby imposing a higher percentage rate on higher-income earners.

High-Income

Earning a substantial amount of money, typically above the median income level in a given region or country.

Low-Income

Referring to individuals or families whose earnings are significantly lower than the average, often quantified by government standards.

Regressive Tax

A tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases.

Q1: When the U.S. government removes investment tax

Q3: Assume we are at an income level

Q8: A U.S. citizen's income from investment in

Q45: Injections to the economy include consumption, investment,

Q60: Refer to Table 9.1. When disposable income

Q64: The difference between gross and net investment

Q82: Other things equal, the currency price of

Q101: Which of the following constitutes a currency

Q105: Other things equal, a decrease in government

Q125: If the inflation rate for a given