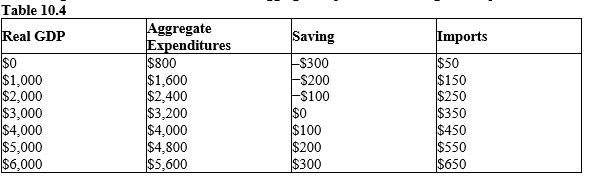

The table given below shows the real GDP, aggregate expenditures, saving, and imports of an economy.?

-Refer to Table 10.4. Suppose the economy is currently in equilibrium and has a potential GDP of $6,000. The current GDP gap equals _____.

Definitions:

Payroll Taxes

Taxes imposed on employers and/or employees, and are based on the salary or wages of the employee.

Payroll Tax

Contributions demanded from either employees or employers, frequently calculated based on the salaries that staff are awarded by their employers.

Personal Income Tax

A tax levied on an individual's total personal income, taking into account wages, salaries, and other sources of income.

Federal Government Spending

Expenditures by the federal government on goods, services, and obligations, including defense, welfare, and public works.

Q7: In the short run, an expansionary monetary

Q12: If the national output cannot be increased

Q36: Refer to Figure 10.4. Compute the increase

Q44: If the average price level falls, the

Q45: A country that experiences a large deficit

Q46: Refer to Figure 14.4. A movement from

Q71: If the U.S. dollar price of one

Q76: If the exchange rate is defined as

Q99: If a depreciation of the British pound

Q109: Identify the correct statement about the aggregate