Scenario 13.1?Assume the following conditions hold.

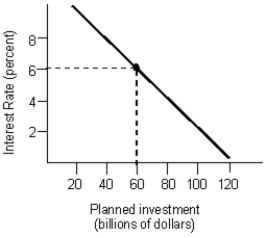

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks. This acts to lower the equilibrium interest rate by 2 percent.

a.At all banks, excess reserves are zero.

b.The deposit expansion multiplier is 3.

c.The investment spending function is as illustrated in the figure below.

-Refer to Scenario 13.1. What is the change in excess reserves following the open market operation by the Fed?

Definitions:

Ozone

A molecule composed of three oxygen atoms, known for its role in absorbing ultraviolet solar radiation in the stratosphere, thus protecting the earth from harmful UV rays.

Climate Models

Computational or mathematical simulations that project the Earth's future climate conditions based on various atmospheric and oceanic variables.

Correspondence

The act of exchanging letters or the process of communication between parties via written documents or emails.

Assumptions

Premises or beliefs taken as true without empirical evidence, often serving as foundational concepts in theoretical models or experiments.

Q13: Import quotas are aimed at increasing the

Q16: The primary international reserve asset is foreign

Q20: In the presence of the crowding out

Q29: Suppose that an economy grows by 4

Q30: Long-term economic growth requires a permanent:<br>A) decline

Q54: The slope of the short-run Phillips curve

Q68: In Figure 10.7, the spending multiplier equals

Q72: Refer to Figure 13.2. Assume that the

Q79: Which of the following statements about the

Q85: When the aggregate expenditures function of a