Scenario 13.2?Assume the following conditions hold.

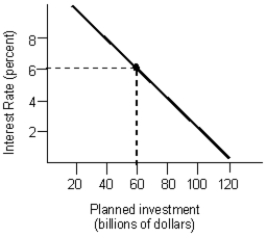

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks. This acts to lower the equilibrium interest rate by 2 percent.

a.At all banks, excess reserves are zero.

b.The deposit expansion multiplier is 3.

c.The spending multiplier is 5.

d.The initial equilibrium level of national income is $500 billion.

e.The initial equilibrium interest rate equals 6 percent.

f.The investment spending function is as illustrated in the figure below.

-Refer to Scenario 13.1. What is the ultimate change in the money supply following the open market operation by the Fed?

Definitions:

Budgeted Fixed Manufacturing Overhead

The estimated total fixed costs required for the manufacturing process, planned in advance for a specific period.

Materials Price Variance

The difference between the actual cost of materials used in production and the budgeted or standard cost, indicating how effectively a company controls its material costs.

Standard Costs

Predetermined costs for materials, labor, and overhead that are used for budgeting and cost control purposes.

Raw Materials

The unprocessed natural materials or substances used in the initial stages of production or manufacturing.

Q16: Assume that the reserve requirement is 10

Q16: Which of the following is not an

Q17: Refer to Table 12.3. What is the

Q27: If a bond pays a fixed return

Q36: Generally speaking, the more competitive a country's

Q36: Refer to Figure 10.4. Compute the increase

Q45: The _ account for about 60 percent

Q89: Suppose an economy operates at a real

Q95: Assume that initially country A exchanges three

Q110: There is an inverse relationship between the