Scenario 13.1?Assume the following conditions hold.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks. This acts to lower the equilibrium interest rate by 2 percent.

a.At all banks, excess reserves are zero.

b.The deposit expansion multiplier is 3.

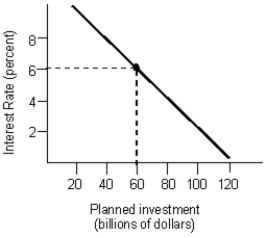

c.The investment spending function is as illustrated in the figure below.

-Refer to Scenario 13.1. What is the change in excess reserves following the open market operation by the Fed?

Definitions:

Market Index

A statistical measure that represents the overall performance of a specific set of stocks or securities.

Wilshire 5000

A stock market index designed to measure the performance of all U.S.-headquartered equity securities with readily available price data.

NAV

Stands for Net Asset Value, which is the value per share of a mutual fund or ETF calculated by dividing the total value of all the securities in the portfolio by the number of shares outstanding.

Income Distributions

Payments made from a fund or account to investors, which can include dividends from stocks or interest from bonds.

Q11: _ have faith in the free market

Q19: Transfer payments that use income to establish

Q19: The primary international reserve asset in most

Q24: In the 1990s, foreign direct investment had

Q55: "The dramatic reduction of the money supply

Q58: Refer to Figure 14.1. The movement from

Q74: Refer to Scenario 10.2. What is the

Q81: Generally, there is a strong positive correlation

Q92: Suppose that an increase in aggregate demand

Q100: Assume that the reserve requirement is 10