Scenario 13.1

Assume the following conditions hold.

a.At all banks, excess reserves are zero.

b.The deposit expansion multiplier is 3.

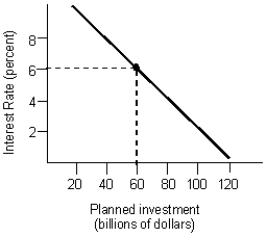

c.The investment spending function is as illustrated in the figure below.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks. This acts to lower the equilibrium interest rate by 2 percent.

-Refer to Scenario 13.1. What is the change in required reserves following the open market operation by the Fed?

Definitions:

Muscle Weakness

A decrease in the strength of one or more muscles, potentially affecting the ability to perform physical tasks.

Mobility Device

A mobility device is an apparatus designed to assist individuals with walking or otherwise improve their mobility, such as crutches, walkers, or wheelchairs.

Bedside Commode

A portable toilet, usually placed near a patient's bed, for individuals who are unable to walk to the bathroom.

Black, Tarry Stools

Feces that are dark in color and sticky in texture, often indicating the presence of digested blood from the gastrointestinal tract.

Q9: Technological advancement implies:<br>A) the increase in the

Q11: Which of the following is most likely

Q19: Transfer payments that use income to establish

Q45: The Federal Reserve System was created in

Q52: The predominant source of multilateral aid is:<br>A)

Q54: Suppose in an economy, investment = $40,

Q85: Suppose the equilibrium level of income exceeds

Q103: Less-developed countries are experiencing rapid population growth

Q115: Changes in autonomous consumption will affect the

Q118: The Keynesian region of the aggregate supply