Scenario 13.2?Assume the following conditions hold.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks. This acts to lower the equilibrium interest rate by 2 percent.

a.At all banks, excess reserves are zero.

b.The deposit expansion multiplier is 3.

c.The spending multiplier is 5.

d.The initial equilibrium level of national income is $500 billion.

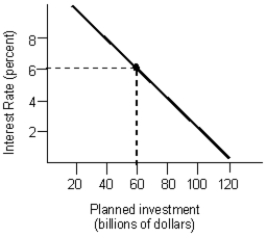

e.The initial equilibrium interest rate equals 6 percent.

f.The investment spending function is as illustrated in the figure below.

-Refer to Scenario 13.1. What is the ultimate change in the money supply following the open market operation by the Fed?

Definitions:

Extraordinary Repair

Significant restorations or overhauls that significantly extend the useful life of an asset beyond its original projection.

Manufacturing Warehouse

A facility where goods are produced or stored, typically involving both machinery and labor in the production process.

Routine Maintenance

Routine maintenance refers to the regular upkeep actions performed to keep equipment or systems functioning efficiently and prevent unforeseen breakdowns.

Accumulated Depreciation

The total amount of depreciation expenses allocated to a fixed asset since it was put into use, reducing its book value.

Q5: Higher taxes affect real GDP indirectly through

Q5: The net export function is negatively sloped

Q14: A country is strongly inward-oriented if exports

Q39: The business cycle that results from the

Q50: In the fixed-price Keynesian model, what would

Q54: The flatter the aggregate supply curve, the

Q56: Consumer spending is considered a determinant of

Q78: Which of the following economic theories take

Q79: Which of the following statements about taxation

Q90: According to the new Keynesians:<br>A) prices adjust